AT A GLANCE

GIG Egypt Life Takaful, established in 2006, is the first joint Takaful life insurance company in Egypt, registered under the Insurance Companies’ Registry No. 22 for 2007.

The company is regulated by the Egyptian Financial Regulatory Authority (FRA) and supervised by a Shariaa Committee to ensure full compliance with Takaful principles.

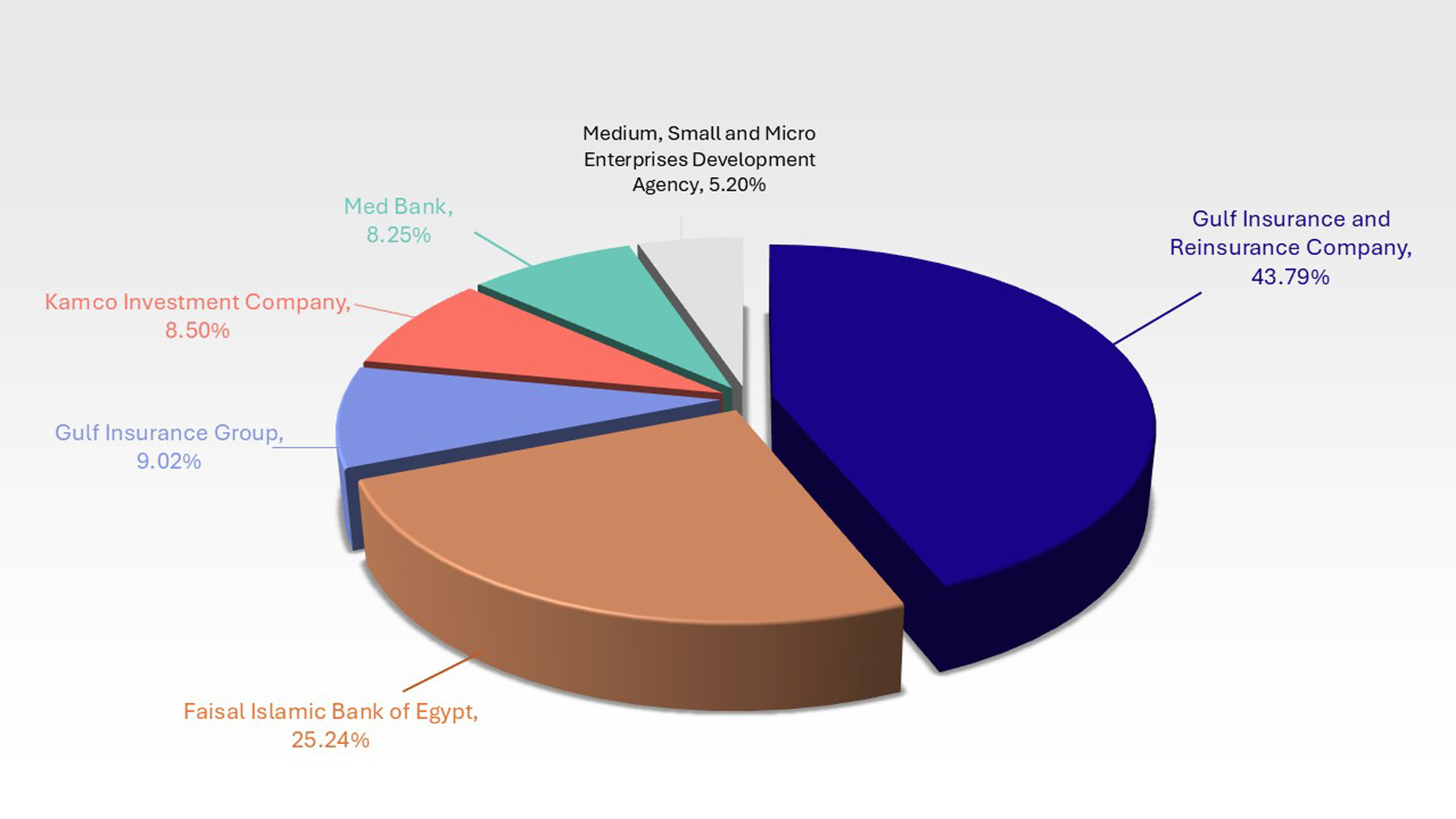

GIG Egypt Life Takaful is part of Gulf Insurance Group (GIG) - one of the largest and most diversified insurance groups in the MENA region, majority-owned by Fairfax Financial Holdings Limited (Canada). Backed by this strong regional and international foundation, the company provides innovative, ethical, and customer-focused insurance solutions across Egypt.